CALIFORNIA STATE UNIVERSITY, SACRAMENTO

Department of Economics

Economics 100A

Prof. Yang

Solutions to Homework Problems Chapter: 1 2 3 4 5 6 7 8 9 10

Chapter 8

Numerical

1. a)

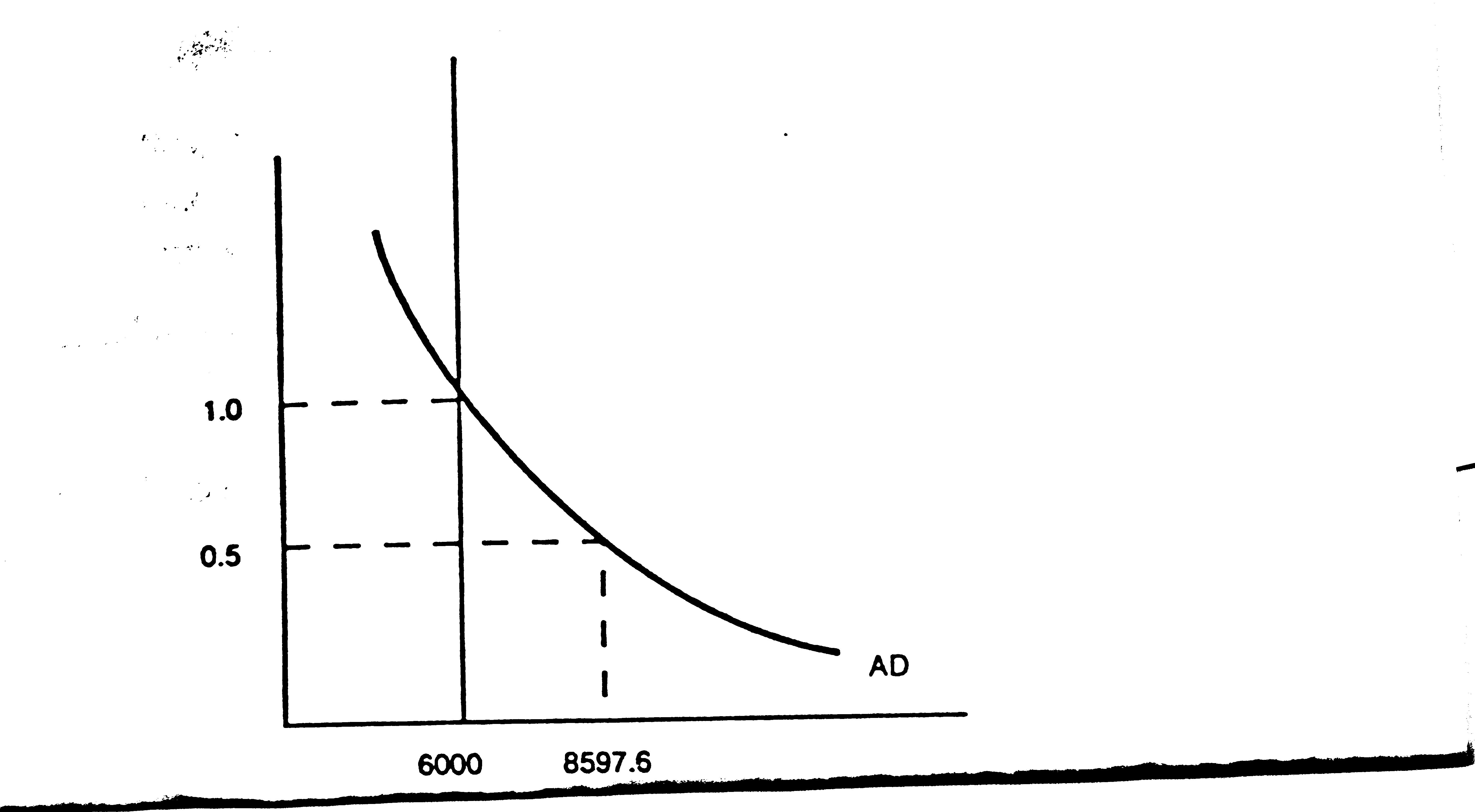

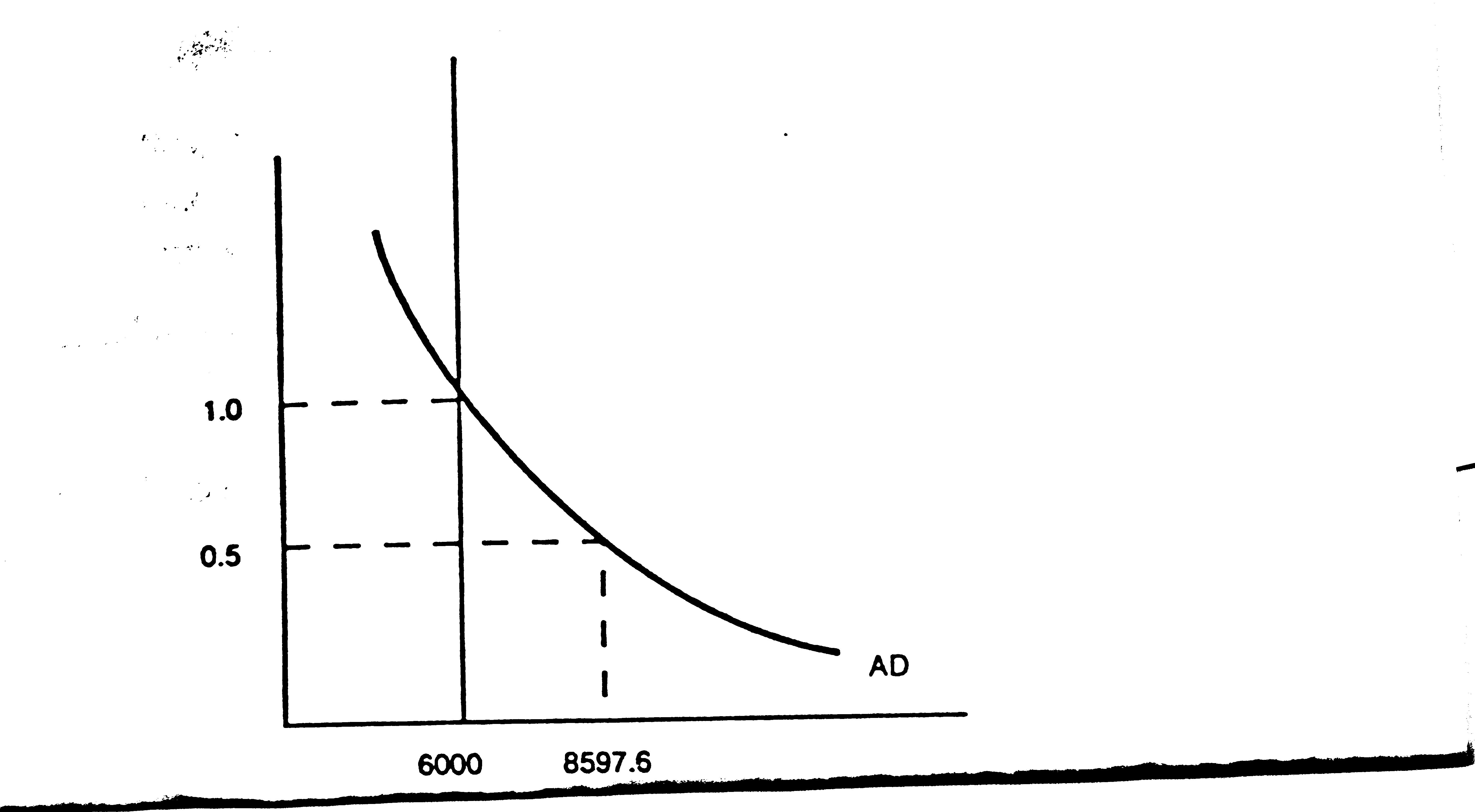

The aggregate demand curve is not a line, but a rectangular hyperbola, because the price level is in the denominator of the real money supply in the aggregate demand equation.

b) If Po = 0.5, then Y= 3,401 + 2.887(900/0.5) = 8597.6. This places upward pressure on prices, since output is above potential.

c)

Year p P Y0 - 0.50 8597.6 1 51.95 0.76 6820.9 2 16.42 0.88 6338.6 3 6.77 0.94 6152.0 4 3.05 0.97 6071.0 5 1.42 0.99 6033.6

d) See the diagram in part a above. The economy does not overshoot, and converges directly to the equilibrium level.

e)

Year p P Y

0 - 0.50 8597.6 1 51.95 0.76 6820.9 2 47.59 1.12 5718.6 3 22.92 1.38 5286.2 4 -0.53 1.37 5296.1 5 -14.39 1.17 5614.8

Now there is overshooting.

f) The term 0.6p represents the inflationary expectations. It leads to overshooting because when output first returns to potential, prices are rising. Therefore, in the next period inflationary expectations cause the price level to continue rising, even though output is no longer above its potential level.

2. a and b) With P = 1, output equals potential (Y* = 6000) when M = 900. With M = 850, and assuming inflation to have been zero in all the preceding years, then:

Year Y p(%) P R C I X0 5855 0.0 1.00 0.077 3909 846 -99 1 5928 -2.9 .97 0.062 3955 876 -99 2 6011 -3.2 .94 0.048 4007 906 -100 3 6056 -1.7 .92 0.035 4035 930 -98 4 6053 0.1 .93 0.044 4033 912 -102 5 6024 1.1 .94 0.049 4015 902 -102

The 1ong-run equilibrium values are Y = 6000, p = 0, P =0.944, R = 0.05, C = 4000, 1 = 900, and X= -100.

c) During the adjustment process, the LM curve moves back and forth across a fixed IS curve. From this observation it is clear that when interest rates overshoot, output undershoots and vice versa (when interest rates are above their long-run values, output is below its long-run equilibrium value and vice-versa). Since consumption only depends on income, and investment only depends on interest rates, the same must hold true for these variables. However, net exports depend (negatively) on income and interest rates; overshooting in one of these variables is partially offset by overshooting in the other. Therefore, no definite pattern of adjustment for X is observable.