CALIFORNIA STATE UNIVERSITY, SACRAMENTO

Department of Economics

Economics 100A

Prof. Yang

Solutions to Homework Problems

Chapter 1

Numerical

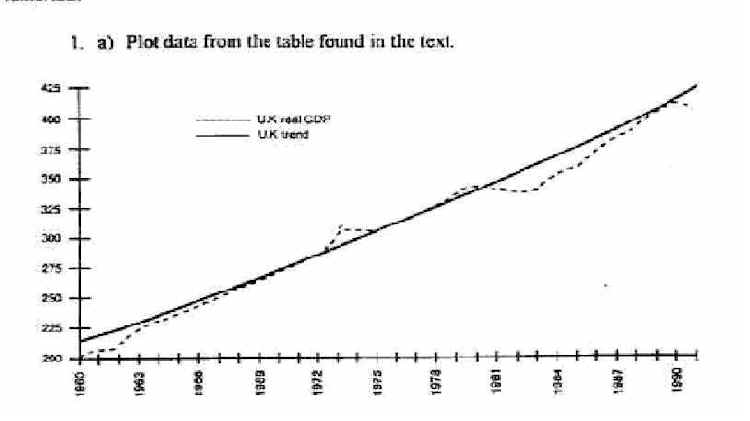

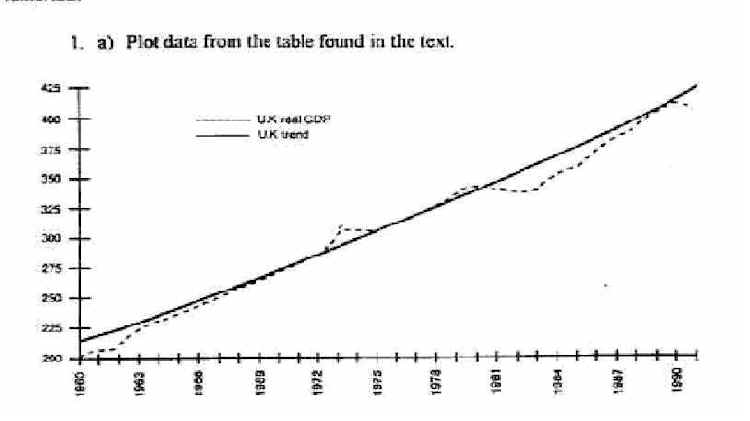

b) Real GDP grew by 2.2% on average between 1960 and 1991.

c) There were only three periods in which

GDP declined: the 1973-75 recession, the 1980-81 recession,

and the 1991 recession.

Those were recessions in the U.S. as well. The U.K. did not experience

the smaller 1969-70

recession.

3. a, b, and c)

Year Inflation p e = .5 (p -1 + p -2) R = i - p e p e = p R = i - p e

1978

7.6%

7.6%

0.0%

1979

11.3

11.3

-1.3

1980

13.5

9.4%

2.0%

13.5

-2.1

1981

10.3

12.4

1.4

10.3

3.5

1982

6.2

11.9

-.8

6.2

4.9

1983

3.2

8.2

.6

3.2

5.6

1984

4.3

4.7

5.2

4.3

5.5

1985

3.6

3.7

3.9

3.6

4.0

1986

1.9

3.9

2.1

1.9

4.1

1987

3.6

2.7

3.4

3.6

2.5

1988

4.1

2.7

4.2

4.1

2.8

1989

4.8

3.8

4.2

4.8

3.2

1990

5.4

4.5

3.0

5.4

2.1

1991

4.2

5.1

.4

4.2

1.3

1992

3.0

4.8

-1.2

3.0

.6

1993

3.0

3.6

- .5

3.0

.2

1994

2.6

3.0

1.7

2.6

2.1

1995

2.8

2.8

2.8

2.8

2.8

d) The real interest rate is defined as the nominal interest rate

minus expected inflation. But economists

have no way of drectly observing agents'

expectations of inflation. Therefore, economists' estimates

of the real rate can vary widely depending on

how they model expectations.

e) People try to forecast inflation rates using all the

information that is available to them at the time of forecast.

They use all kinds of information: economic,

political, environmental, etc. Naturally, they do not

systematically understimate changes in the

level of prices. Sometimes they underestimate and sometimes

they overestimate.

Analytical

1. In the flexible price model, output is determined by

aggregate sypply. Only fluctuations in aggregate

supply can produce fluctuations in output.

In the sticky price model, by contrast, output is completely

demand determined.

2. a) While such a view could explain a fall in output, it

cannot explain the increase in unemployment rates

that occurred in the

early 1980s. This is the new classical or flexible price view of macroeconomic

fluctuations.

b) Interest rates, particularly real rates,

were very high, a result of restrictive monetary policy. This depressed

aggregate

demand, and hence both output and the demand for labor. This accounts for the high

levels of

unemployment. This is a sticky price or Keynesian view of output

fluctuations. The challenfe for this view

is to explain why wages

do not adjust quickly.