Personal Savings

The personal savings

rate is one of the numerous statistics the government gives us every month and

it is essentially whatís left of our income after we pay taxes, mortgage, car

payments, living expense, etc. In 1946 the United States started for the first

time to gather personal savings data so it could be used for economic research.

Throughout the history of personal savings in the United States, Americanís had

a positive savings rate. But, just recently, personal

savings actually fell to zero the last three months of 1998 and went into

negative territory in February, 1999.

In the early-1950ís to the mid-1970ís personal savings rates did see a slight growth rate which was around eight percent of personal disposable income. After this growth in personal savings, there has been a downward trend that hit its peak in late 1998. This trend has been mostly overlooked because of the strength of the overall economy. Some economist speculate that this downward trend in savings starting from 1975.

Some

economics say that savings plays an intricate role in our economy because it

critical to capital formation. Capital formation is crucial for our economic

growth and rising wages. This is point is illustrated by almost every economist

theory. Since savings is the basis of how money is borrowed, it makes it

possible to build factories, purchase equipment, conduct research, and develop

technology.

The trend of lack of savings in the United States is a great concern because it can have a negative effect on todayís worker. In the short-run when workers spend all their disposable income while saving little, the economy would prosper. But, in the long-run when these workers retiree, they wonít have adequate savings for all their retirement needs which include health care and living expenses. Experts conclude you will need approximately 60 percent to 80 percent of your current income each year to address all your retirement requirements. The typical American depends on multiply sources for their retirement needs. Generally, these sources come from Social Security, employer provided retirement benefits, and personal savings. Due to the present state of Social Security, it might become insolvent for future generations and might not be guaranteed to be there in the future. While employer provided retirement benefits are also a good source for retirement income, it probably wonít have a large enough cash flow for your retirement. Well-managed personal savings can protect you from any short falls there might be in the future.

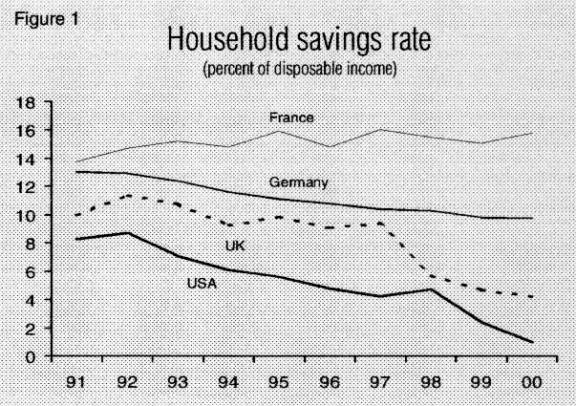

When you compare the United States savings rate to other developed countries you find that America is at the bottom of the heap. The chart below illustrates this point.

The chart below shows you the percentage of savings to GDP in 1996 for several countries. Again, the U.S. ranks among the lowest with its savings percentage of 15%.

|

|

GDP |

Savings as

Percentage of GDP |

|

Switzerland |

$171b. |

28% |

|

Japan |

$2,668b. |

34% |

|

U.S. |

$6,738b. |

15% |

|

Singapore |

$66b. |

52% |

|

France |

$1,147b. |

21% |

|

Germany |

$1,643b. |

22% |

|

Hong Kong |

$140b. |

30% |

|

Brunei |

$5.9b. |

35% |

|

Australia |

$340b. |

19% |

|

Italy |

$1,064b. |

20% |

|

Canada |

$619b. |

19% |

|

Britain |

$1,054b. |

15% |

|

Macau |

$6.7b. |

28% |

|

New Zealand |

$60b. |

24% |

|

Taiwan |

$279b. |

27% |

|

South Korea |

$468b. |

35% |

|

Saudi Arabia |

$208b. |

27% |

|

Malaysia |

$171b. |

34% |

|

Brazil |

$921b. |

21% |

|

South Africa |

$160b. |

19% |

|

Mexico |

$650b. |

17% |

|

Thailand |

$408b. |

37% |

|

Fiji |

$4.3b. |

19% |

|

Iran |

$328b. |

30% |

The current way the government measures personal savings

rate is up for debate. Numerous organizations and individuals say itís an

inaccurate interpretation of the real savings rate for a few reasons. The

present system currently ignores buildups in mutual funds and those of tax

sheltered 401(k). It also neglects individual retirement accounts. Another fact

is it doesnít take into account the Social Security payroll taxes that are

being paid for the present year. It is estimated that 126 billion of it is

beyond what is being paid out for benefits. Finally, the current statistics

count pension plan contributions that employers make to a worker's account as

"personal income" to the worker, even though it wont be paid for

years.

A revised

statistically working of personally savings paints a different story. The Bureau

of Economic Analysis decided to recalculate the PSR. Instead of putting

government workers retirement plans into the category of government savings,

they put it into personal savings. Once this was done, the personal saving rate

didnít like so menacing.† The graph

below illustrates this point.

Having a low

savings rate isnít necessarily a bad thing; it does have its pros and cons. It

does allow for consumption demand to grow beyond the increase in income.

However, having a low savings rate also has a bad side to it. The negative part

of it is U.S. current account (trade balance) has a higher deficit.

Economically speaking you can look at a low savings a few different ways. In

terms of retirement, it is absolutely necessary for people to increase their

savings. Given the current condition of Social Security and Medicare in terms

of becoming insolvent, it makes it more necessary for people to start saving

more.